N225 managed to get back below the top Bollinger Band, but not much. And the band has widen. N225 has been grinding up since August 8 low. This is no good for selling Iron Condor or even just Call/Put spread. The low volatility didn't provide good premium. In fact, I couldn't find a good premium to sell Put spread to form Iron Condor. And, the Call spread is being challenged every time N225 edges up. Should I consider buying option instead of just selling option?

Both the weekly and monthly chart continue to look bullish. Not much has changed.

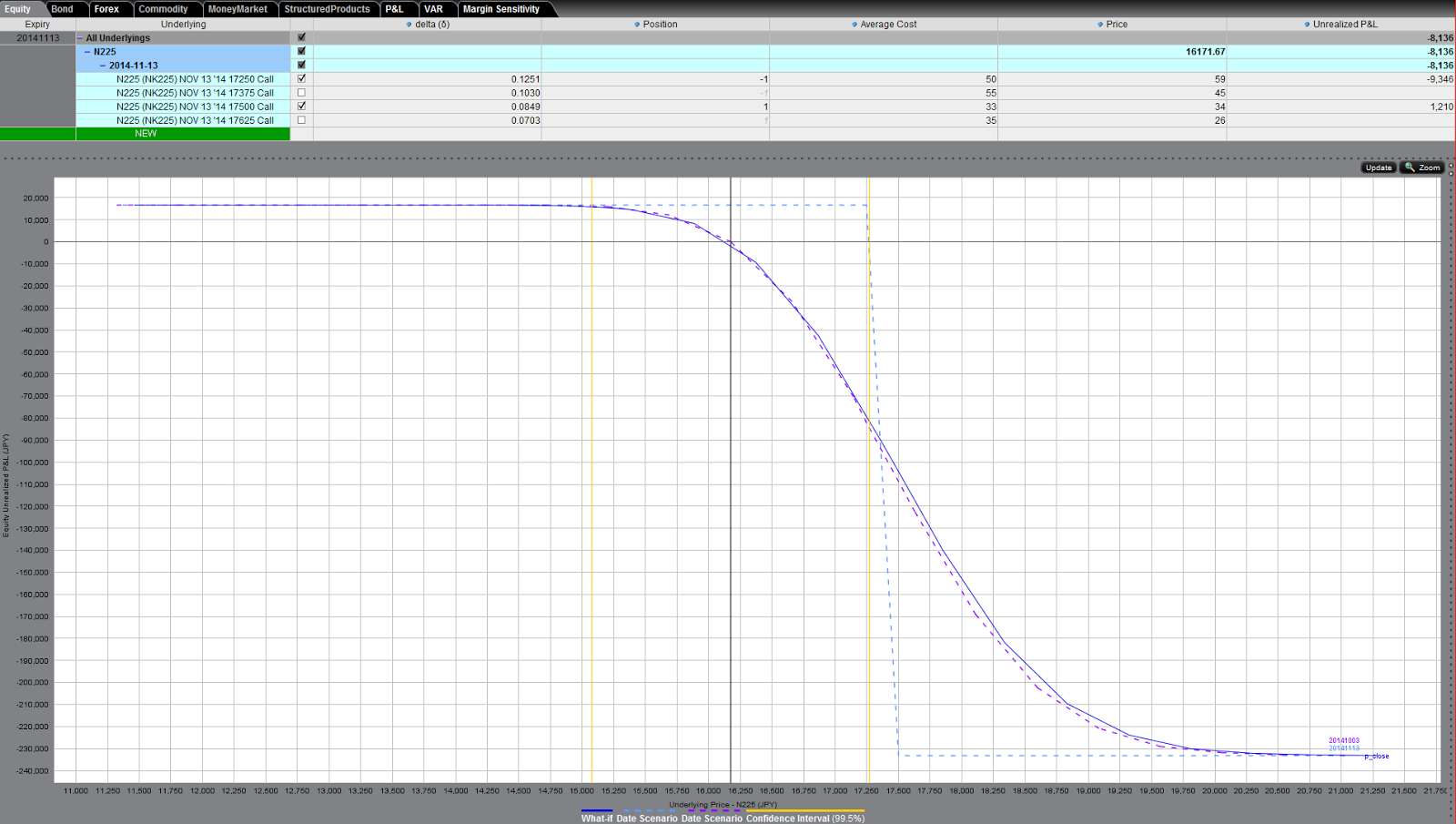

November Position : Call Spread 17250/17500, 17375/17625

November 17250/17500 position is currently at a paper loss of about 8 points (JPY 8,000, before commission). N225 is about 1020 points away from the Short Call. Delta is at 0.1252. DTE is 47 days. This position looks ok. Just need to keep a watch on the Delta movement.

November 17250/17500 position is currently at a paper loss of about 8 points (JPY 8,000, before commission). N225 is about 1020 points away from the Short Call. Delta is at 0.1252. DTE is 47 days. This position looks ok. Just need to keep a watch on the Delta movement.

November 17375/17625 position is currently at a paper gained of about 1 points (JPY 1,000, before commission). N225 is about 1145 points away from the Short Call. Delta is at 0.1030. DTE is 47 days. This position looks ok. No action needed.

No comments:

Post a Comment