This is my second set of Live Trades, on Korea KOSPI 200 Index Option (K200).

After my first live trade on ES, I wanted some Options that are active during my day time (Singapore time). And I ended trading KOSPI 200 Index Option.

(I will have another post explaining the various Asia Pacific exchanges Index Options or Futures Options that I explore.)

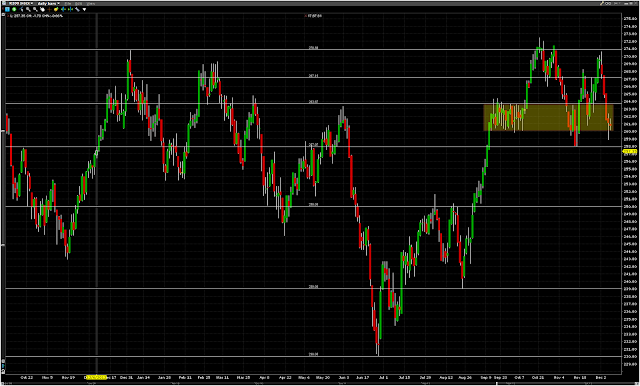

The below chart is K200 Index Daily chart as at 25-Nov. I saw that K200 Index has been on uptrend since July. October retracement stopped at about 258 before climbing up again. I want a Strike price at July swing low of 230 or August swing low of 240 as the support. But the premium for Put Option is so low that I cannot even create a Vertical Spread.

So, I chosen the nearest swing low on November of 258 as the support, which I was a bit worry (will elaborate more in subsequent post). And I also enter a trade at the the last resistance in August of 250, hoping that the resistance will become a support.

I did two trades on K200 Index Option on two separate days:

25-Nov : Sell 5 contracts of K200 Vertical Spread DEC12'13 257.5/255.0 Put

26-Nov : Sell 5 contracts of K200 Vertical Spread DEC12'13 250.0/247.5 Put

Order preview for K200 Vertical Spread DEC12'13 257.5/255.0 Put. I forgot to create the image for Order preview for the 250.0/247.5 Put spread.

The below are the trades report. As can be seen, the premium for 257.5/255.0 spread is KRW 450,000.00 (before commission), double of the 250.0/247.5 spread of KRW 225,000.00 (before commission).

I added another two contract of 257.5/255.0 on 6-Dec. As you can see, the last few days drop paused at the shaded region where price was stalled in the last climb. I expect the price to hold. It seems to hold. And the premium was attractive. With just 2 contracts, the premium (KRW 400,000.00) collected is about the same as the 5 contracts I sold on 25-Nov (KRW 450,000.00).

This is at Expiration on 12-Dec. K200 Index close at 259.05, touching low at 257.20. All contracts expired worthless. So, I got to keep the full KRW 1,065,690 (which is USD 1,013.49) premium (after commision/fee) as profit.

No comments:

Post a Comment