There are many reasons why I choose ES over Stock Option. Firstly, this is the Futures that I am trading daily. I am looking at the chart, the numbers, everyday. I am familiar with ES characteristic: what is the usual range, what is the support and resistance, etc.

Secondly, ES is traded almost 24 hours. This solve the problem I have with US Stock Option. To execute a trade for US Stock Option, I need to start trading at 9.30pm. With Daylight saving now, it is 10.30pm. I am not a night person. Trading at that late hours didn't get my full attention, focus or energy.

Thirdly, ES has high liquidity, thus spread is narrow. It also has both End-of-month and Weekly options. There are many expiration dates you can choose.

Let me start with some guideline for Selling Put Spread first:

1. Expiration : up to one month

- as a seller of Put Spread, time decay is helpful to my position

- i want to give the party on the other side of this trade (buyer) as little time to be right as possible

2. Strike Price : OTM at support/resistance

- for a Short Put Spread to make maximum gain (the full credit received), I need the price to stay above the higher Strike price.

- the current price can go down a bit as long as it stay above the higher Strike price at expiration, we get to keep the full credit.

- so, I need to give the underlying asset some room to move up & down, but not below the higher Strike price

- therefore, the higher Strike price will be at strong support level.

3. Premium/Yield : 10%-20%

- for a 10 points (ES is price in points instead of dollars. Each point is $50) spread, I need to get at least 1 point in premium

- I got this guideline/idea from a book, "Options made Easy" by Guy Cohen

- I will need to revisit this guideline as this is very different from Futures/Forex trading Risk:Reward ratio. For 10% premium yield, it is basically risking 10 points ($500) for 1 point ($50) reward. Risk:Reward ratio is 10:1. This is really bad for Futures/Forex trading. We would normally want to risk $1 to get $2 or $3 reward.

Let's look at some charts to help determine what Put Spread to sell.

This is ES weekly chart as at 1-Nov. Again, a very clear uptrend. The range of each week movement is about 40 points in the middle, with a high of about 80 points.

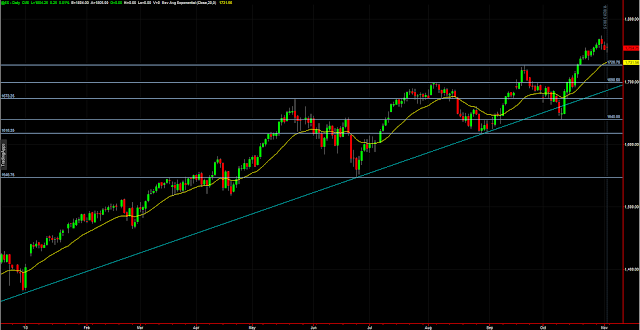

This is ES daily chart when I open my First Option position on 1-Nov.

Strike Price : OTM at support/resistance

- As you can see from the chart, the first support is 1726.75, that is about 28 points away from the current 1754.75. It is too close for me to consider. A weekly movement of 40 points could easily hit pass this first support.

- I wanted a safer support at 1640, which is >110 points away.

- Or at least at the support at 1700, which is 54 points away. It is a second last swing which I think it should hold.

Expiration : up to one month And Premium/Yield : 10%-20%

- At 1640, I cannot find a premium that meet the guideline above. That is to say, I cannot even get 10% yield with up to one month expiration. Not attractive at all.

- I found one at 1700/1690, with expiration on 22-Nov, less than 1 month. 1 point premium with 10 point spread.

This is my trade on 1-Nov.

This is the daily chart as at 22-Nov. Price didn't even fall below the first support line 1726.76. It went all the way to 1736.50 before bouncing off. This will add lots of stress for me if I really sell the Put Spread at 1725. So, 1700/1690 Put Spread is easier to manage, at least for first trade. But, of course, I will get a higher premium if I sold the 1725/1715 Put Spread.

This is at Expiration on 22-Nov. So, no commission.

This is the Profit & Loss on 22-Nov. $471.60, after commission.

No comments:

Post a Comment