My last live trade in December.

As you can see from the chart as at 30-Nov, it is clearly a uptrend. A good last swing low will be at about 1650. But the premium is too low to sell the credit put spread. After going through different strikes, I selected 1760/1750 put spread, with USD 625 (after commission 596.60) premium.

This is the Order Preview. Initial/Maintenance Margin is 4,388/3,511. Return On Margin (ROM) is 14.24%/17.80% (13.59%/16.99% after comission) for 20 days.

This is the trade transaction.

This is the chart as at 20-Dec. ES once droped to a low of 1760.25, just 1 tick above my Short Strike. With Bernanke's tapering announcement of reducing bond buying by $10 billion a month and keeping interest rate as it is (not raising the interest rates until 2015 at the earliest), ES rallied to close at 1810.75. The next two days ES Dec future contract stayed about the same level and end at 1812.89.

Thus, the option expired worthless.

This the trade for expiration (no commission).

With this, my total December income is USD 1,610.09 (596.60+1,013.49 posted here), met my monthly income goal as described in my Trading Plan. This Trading Plan is still work in progress. I will update it as I learn through reading, trading.

This blog is to pen down my journey of trading Options. I focus primary on the Options in Asia Pacific, especially KOSPI 200 Options in Korea Stock Exchange (KRE). The main strategy is Selling Options, in particular Credit Spread and Iron Condor.

Monday, December 23, 2013

Sunday, December 22, 2013

Weekly Review

Trade 1 : Selling ASML Vertical Spread DEC2013 87.5/85 Put

ASML was hovering around the last week close 88.10 for a few days before it went up, maybe due to the tapering announcement. It close at 91.48, above both of our strike price. The option expired worthless.

This is the closing trade with 174.82 profit.

This trade is an evidence of the benefit of selling that i described in this Selling Options post.

For Options seller, say Put Options, we just need to be right that price didn't drop a lot. We will make a profit 4 out of 5 scenario below:

1. Stay flat (win)

2. Rise a little (win)

3. Rise a lot (win)

4. Drop a little (win)

5. Drop a lot (loss)

I was bullish on this stock when it had a pin bar at the last resistance turned support. And it was on its uptrend. However, it didn't went up as expected. It closed with a drop a little that still result in a winning trade.

Going forward, I will blog on live trade instead of demo trade. This will be the last post on demo trade.

ASML was hovering around the last week close 88.10 for a few days before it went up, maybe due to the tapering announcement. It close at 91.48, above both of our strike price. The option expired worthless.

This is the closing trade with 174.82 profit.

This trade is an evidence of the benefit of selling that i described in this Selling Options post.

For Options seller, say Put Options, we just need to be right that price didn't drop a lot. We will make a profit 4 out of 5 scenario below:

1. Stay flat (win)

2. Rise a little (win)

3. Rise a lot (win)

4. Drop a little (win)

5. Drop a lot (loss)

I was bullish on this stock when it had a pin bar at the last resistance turned support. And it was on its uptrend. However, it didn't went up as expected. It closed with a drop a little that still result in a winning trade.

Going forward, I will blog on live trade instead of demo trade. This will be the last post on demo trade.

Sunday, December 15, 2013

Second set of Live Trades

This is my second set of Live Trades, on Korea KOSPI 200 Index Option (K200).

After my first live trade on ES, I wanted some Options that are active during my day time (Singapore time). And I ended trading KOSPI 200 Index Option.

(I will have another post explaining the various Asia Pacific exchanges Index Options or Futures Options that I explore.)

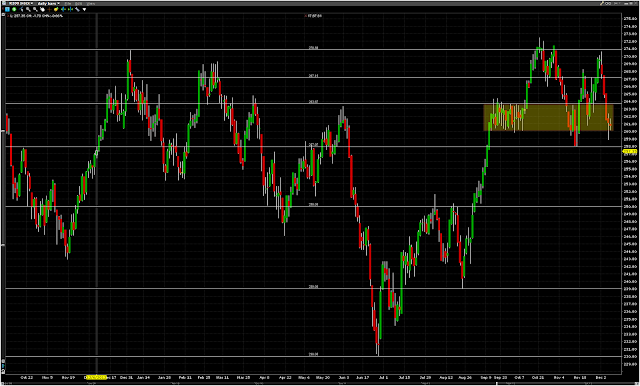

The below chart is K200 Index Daily chart as at 25-Nov. I saw that K200 Index has been on uptrend since July. October retracement stopped at about 258 before climbing up again. I want a Strike price at July swing low of 230 or August swing low of 240 as the support. But the premium for Put Option is so low that I cannot even create a Vertical Spread.

So, I chosen the nearest swing low on November of 258 as the support, which I was a bit worry (will elaborate more in subsequent post). And I also enter a trade at the the last resistance in August of 250, hoping that the resistance will become a support.

I did two trades on K200 Index Option on two separate days:

25-Nov : Sell 5 contracts of K200 Vertical Spread DEC12'13 257.5/255.0 Put

26-Nov : Sell 5 contracts of K200 Vertical Spread DEC12'13 250.0/247.5 Put

Order preview for K200 Vertical Spread DEC12'13 257.5/255.0 Put. I forgot to create the image for Order preview for the 250.0/247.5 Put spread.

The below are the trades report. As can be seen, the premium for 257.5/255.0 spread is KRW 450,000.00 (before commission), double of the 250.0/247.5 spread of KRW 225,000.00 (before commission).

I added another two contract of 257.5/255.0 on 6-Dec. As you can see, the last few days drop paused at the shaded region where price was stalled in the last climb. I expect the price to hold. It seems to hold. And the premium was attractive. With just 2 contracts, the premium (KRW 400,000.00) collected is about the same as the 5 contracts I sold on 25-Nov (KRW 450,000.00).

This is at Expiration on 12-Dec. K200 Index close at 259.05, touching low at 257.20. All contracts expired worthless. So, I got to keep the full KRW 1,065,690 (which is USD 1,013.49) premium (after commision/fee) as profit.

After my first live trade on ES, I wanted some Options that are active during my day time (Singapore time). And I ended trading KOSPI 200 Index Option.

(I will have another post explaining the various Asia Pacific exchanges Index Options or Futures Options that I explore.)

The below chart is K200 Index Daily chart as at 25-Nov. I saw that K200 Index has been on uptrend since July. October retracement stopped at about 258 before climbing up again. I want a Strike price at July swing low of 230 or August swing low of 240 as the support. But the premium for Put Option is so low that I cannot even create a Vertical Spread.

So, I chosen the nearest swing low on November of 258 as the support, which I was a bit worry (will elaborate more in subsequent post). And I also enter a trade at the the last resistance in August of 250, hoping that the resistance will become a support.

I did two trades on K200 Index Option on two separate days:

25-Nov : Sell 5 contracts of K200 Vertical Spread DEC12'13 257.5/255.0 Put

26-Nov : Sell 5 contracts of K200 Vertical Spread DEC12'13 250.0/247.5 Put

Order preview for K200 Vertical Spread DEC12'13 257.5/255.0 Put. I forgot to create the image for Order preview for the 250.0/247.5 Put spread.

The below are the trades report. As can be seen, the premium for 257.5/255.0 spread is KRW 450,000.00 (before commission), double of the 250.0/247.5 spread of KRW 225,000.00 (before commission).

I added another two contract of 257.5/255.0 on 6-Dec. As you can see, the last few days drop paused at the shaded region where price was stalled in the last climb. I expect the price to hold. It seems to hold. And the premium was attractive. With just 2 contracts, the premium (KRW 400,000.00) collected is about the same as the 5 contracts I sold on 25-Nov (KRW 450,000.00).

This is at Expiration on 12-Dec. K200 Index close at 259.05, touching low at 257.20. All contracts expired worthless. So, I got to keep the full KRW 1,065,690 (which is USD 1,013.49) premium (after commision/fee) as profit.

Saturday, December 14, 2013

Weekly Review

Trade 1 : Selling ASML Vertical Spread DEC2013 87.5/85 Put

ASML drop down to 88.10, just 0.60 above our higher strike price of 87.5. This is not looking good. With another week to go, will ASML hold above 87.5? The spread was sold for 0.35. So, the Break Even point is 87.15 (87.5 - 0.35). If ASML goes below 87.15, I will start to incur loss.

It was said that Delta is another way of looking at the probability that the option will go ITM (In The Money). Delta for 87.5 Put is currently at 0.4135, which means 41.35% of getting ITM. This is very bad.

Can I roll? Should I roll? Rolling is a concept that I still have not grasp. To me, it is no difference of closing the current position and open a new position. Anyhow, I will cover/explore this in another post.

ASML drop down to 88.10, just 0.60 above our higher strike price of 87.5. This is not looking good. With another week to go, will ASML hold above 87.5? The spread was sold for 0.35. So, the Break Even point is 87.15 (87.5 - 0.35). If ASML goes below 87.15, I will start to incur loss.

The Loss is now $130.

It was said that Delta is another way of looking at the probability that the option will go ITM (In The Money). Delta for 87.5 Put is currently at 0.4135, which means 41.35% of getting ITM. This is very bad.

Can I roll? Should I roll? Rolling is a concept that I still have not grasp. To me, it is no difference of closing the current position and open a new position. Anyhow, I will cover/explore this in another post.

Friday, December 13, 2013

Karen SuperTrader - Made $41 Million Profit in 3 Years Option Trading

Saw these two YouTube videos from tastytrade. Inspiring for retail trader, for me at least.

Video1

Video2

Video1

Video2

Sunday, December 8, 2013

Weekly Review

Trade 1 : Selling ASML Vertical Spread DEC2013 87.5/85 Put

ASML stop climbing up and drop to 91.45 last week close. With another 2 weeks to close before expiration. We will get to keep the full premium as long as ASML stay above 87.5.

Profit is just $30. Let's continue to monitor for next 2 weeks.

ASML stop climbing up and drop to 91.45 last week close. With another 2 weeks to close before expiration. We will get to keep the full premium as long as ASML stay above 87.5.

Profit is just $30. Let's continue to monitor for next 2 weeks.

Friday, November 29, 2013

First Live Trade

After about two months of testing in demo/paper account, I finally executed my first live trade using real money. Instead of Equity/Stock Option, I traded Futures Option instead, specifically E-mini S&P 500 Futures Options (Symbol: ES)

There are many reasons why I choose ES over Stock Option. Firstly, this is the Futures that I am trading daily. I am looking at the chart, the numbers, everyday. I am familiar with ES characteristic: what is the usual range, what is the support and resistance, etc.

Secondly, ES is traded almost 24 hours. This solve the problem I have with US Stock Option. To execute a trade for US Stock Option, I need to start trading at 9.30pm. With Daylight saving now, it is 10.30pm. I am not a night person. Trading at that late hours didn't get my full attention, focus or energy.

Thirdly, ES has high liquidity, thus spread is narrow. It also has both End-of-month and Weekly options. There are many expiration dates you can choose.

Let me start with some guideline for Selling Put Spread first:

1. Expiration : up to one month

- as a seller of Put Spread, time decay is helpful to my position

- i want to give the party on the other side of this trade (buyer) as little time to be right as possible

2. Strike Price : OTM at support/resistance

- for a Short Put Spread to make maximum gain (the full credit received), I need the price to stay above the higher Strike price.

- the current price can go down a bit as long as it stay above the higher Strike price at expiration, we get to keep the full credit.

- so, I need to give the underlying asset some room to move up & down, but not below the higher Strike price

- therefore, the higher Strike price will be at strong support level.

3. Premium/Yield : 10%-20%

- for a 10 points (ES is price in points instead of dollars. Each point is $50) spread, I need to get at least 1 point in premium

- I got this guideline/idea from a book, "Options made Easy" by Guy Cohen

- I will need to revisit this guideline as this is very different from Futures/Forex trading Risk:Reward ratio. For 10% premium yield, it is basically risking 10 points ($500) for 1 point ($50) reward. Risk:Reward ratio is 10:1. This is really bad for Futures/Forex trading. We would normally want to risk $1 to get $2 or $3 reward.

This is ES monthly chart as at 1-Nov. It is a clear uptrend since 2009 bottom. It is up all time high.

This is ES weekly chart as at 1-Nov. Again, a very clear uptrend. The range of each week movement is about 40 points in the middle, with a high of about 80 points.

This is ES daily chart when I open my First Option position on 1-Nov.

Strike Price : OTM at support/resistance

- As you can see from the chart, the first support is 1726.75, that is about 28 points away from the current 1754.75. It is too close for me to consider. A weekly movement of 40 points could easily hit pass this first support.

- I wanted a safer support at 1640, which is >110 points away.

- Or at least at the support at 1700, which is 54 points away. It is a second last swing which I think it should hold.

Expiration : up to one month And Premium/Yield : 10%-20%

- At 1640, I cannot find a premium that meet the guideline above. That is to say, I cannot even get 10% yield with up to one month expiration. Not attractive at all.

- I found one at 1700/1690, with expiration on 22-Nov, less than 1 month. 1 point premium with 10 point spread.

This is my trade on 1-Nov.

This is the daily chart as at 22-Nov. Price didn't even fall below the first support line 1726.76. It went all the way to 1736.50 before bouncing off. This will add lots of stress for me if I really sell the Put Spread at 1725. So, 1700/1690 Put Spread is easier to manage, at least for first trade. But, of course, I will get a higher premium if I sold the 1725/1715 Put Spread.

This is at Expiration on 22-Nov. So, no commission.

This is the Profit & Loss on 22-Nov. $471.60, after commission.

There are many reasons why I choose ES over Stock Option. Firstly, this is the Futures that I am trading daily. I am looking at the chart, the numbers, everyday. I am familiar with ES characteristic: what is the usual range, what is the support and resistance, etc.

Secondly, ES is traded almost 24 hours. This solve the problem I have with US Stock Option. To execute a trade for US Stock Option, I need to start trading at 9.30pm. With Daylight saving now, it is 10.30pm. I am not a night person. Trading at that late hours didn't get my full attention, focus or energy.

Thirdly, ES has high liquidity, thus spread is narrow. It also has both End-of-month and Weekly options. There are many expiration dates you can choose.

Let me start with some guideline for Selling Put Spread first:

1. Expiration : up to one month

- as a seller of Put Spread, time decay is helpful to my position

- i want to give the party on the other side of this trade (buyer) as little time to be right as possible

2. Strike Price : OTM at support/resistance

- for a Short Put Spread to make maximum gain (the full credit received), I need the price to stay above the higher Strike price.

- the current price can go down a bit as long as it stay above the higher Strike price at expiration, we get to keep the full credit.

- so, I need to give the underlying asset some room to move up & down, but not below the higher Strike price

- therefore, the higher Strike price will be at strong support level.

3. Premium/Yield : 10%-20%

- for a 10 points (ES is price in points instead of dollars. Each point is $50) spread, I need to get at least 1 point in premium

- I got this guideline/idea from a book, "Options made Easy" by Guy Cohen

- I will need to revisit this guideline as this is very different from Futures/Forex trading Risk:Reward ratio. For 10% premium yield, it is basically risking 10 points ($500) for 1 point ($50) reward. Risk:Reward ratio is 10:1. This is really bad for Futures/Forex trading. We would normally want to risk $1 to get $2 or $3 reward.

Let's look at some charts to help determine what Put Spread to sell.

This is ES weekly chart as at 1-Nov. Again, a very clear uptrend. The range of each week movement is about 40 points in the middle, with a high of about 80 points.

This is ES daily chart when I open my First Option position on 1-Nov.

Strike Price : OTM at support/resistance

- As you can see from the chart, the first support is 1726.75, that is about 28 points away from the current 1754.75. It is too close for me to consider. A weekly movement of 40 points could easily hit pass this first support.

- I wanted a safer support at 1640, which is >110 points away.

- Or at least at the support at 1700, which is 54 points away. It is a second last swing which I think it should hold.

Expiration : up to one month And Premium/Yield : 10%-20%

- At 1640, I cannot find a premium that meet the guideline above. That is to say, I cannot even get 10% yield with up to one month expiration. Not attractive at all.

- I found one at 1700/1690, with expiration on 22-Nov, less than 1 month. 1 point premium with 10 point spread.

This is my trade on 1-Nov.

This is the daily chart as at 22-Nov. Price didn't even fall below the first support line 1726.76. It went all the way to 1736.50 before bouncing off. This will add lots of stress for me if I really sell the Put Spread at 1725. So, 1700/1690 Put Spread is easier to manage, at least for first trade. But, of course, I will get a higher premium if I sold the 1725/1715 Put Spread.

This is at Expiration on 22-Nov. So, no commission.

This is the Profit & Loss on 22-Nov. $471.60, after commission.

Biweekly Review

Missed last week review. This is more a Biweekly Review

Trade 1 : Buying Put Option - KO NOV2013 40 Put and KO DEC2013 40 Put

Didn't stay up to close the position on Monday. Instead close the position on Tuesday.

Unrealized P&L ($):

As at 04-Oct : 355 (Nov: 240; Dec: 115)

As at 11-Oct : 157 (Nov: 134; Dec: 64)

As at 18-Oct : -100 (Nov: -70; Dec: -30)

As at 25-Oct : -56 (Dec: -56)

As at 08-Nov : -128 (Dec: -128)

Realized P&L ($):

KO 16NOV13 40.0 Put : $236.46 - $343.13 = $-106.67

KO 21DEC13 40.0 Put : $92 - $212.07 = $-121.13

On hindsight, it was a poor trade management that turn profit into a loss.

Trade 2 : Selling Naked Put Option - ASML DEC2013 87.5 Put and ASML Vertical Spread DEC2013 87.5/85 Put

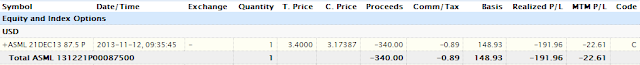

Naked Put was close on the same Tuesday, taking a loss of $-191.96.

I continue to keep the Vertical Spead. It has a little profit now as the price bounced off from the support at 86.96.

Trade 1 : Buying Put Option - KO NOV2013 40 Put and KO DEC2013 40 Put

Didn't stay up to close the position on Monday. Instead close the position on Tuesday.

Unrealized P&L ($):

As at 04-Oct : 355 (Nov: 240; Dec: 115)

As at 11-Oct : 157 (Nov: 134; Dec: 64)

As at 18-Oct : -100 (Nov: -70; Dec: -30)

As at 25-Oct : -56 (Dec: -56)

As at 08-Nov : -128 (Dec: -128)

Realized P&L ($):

KO 16NOV13 40.0 Put : $236.46 - $343.13 = $-106.67

KO 21DEC13 40.0 Put : $92 - $212.07 = $-121.13

On hindsight, it was a poor trade management that turn profit into a loss.

Trade 2 : Selling Naked Put Option - ASML DEC2013 87.5 Put and ASML Vertical Spread DEC2013 87.5/85 Put

Naked Put was close on the same Tuesday, taking a loss of $-191.96.

I continue to keep the Vertical Spead. It has a little profit now as the price bounced off from the support at 86.96.

Monday, November 11, 2013

Weekly Review

Missed last week review.

Trade 1 : Buying Put Option - KO NOV2013 40 Put and KO DEC2013 40 Put

For the past 2 weeks, KO has been ranging around 40.00. And it seems that 40.00 will hold. As such, I will close the remaining Dec position when market opens on Monday.

Unrealized P&L ($):

As at 04-Oct : 355 (Nov: 240; Dec: 115)

As at 11-Oct : 157 (Nov: 134; Dec: 64)

As at 18-Oct : -100 (Nov: -70; Dec: -30)

As at 25-Oct : -56 (Dec: -56)

As at 08-Nov : -128 (Dec: -128)

Realized P&L ($):

KO 16NOV13 40.0 Put : $236.46 - $343.13 = $-106.67

Trade 2 : Selling Naked Put Option - ASML DEC2013 87.5 Put and ASML Vertical Spread DEC2013 87.5/85 Put

The Pin Bar didn't work out. ASML after 1 week of failing to move above 95.00, fell sharply to 87.37, near support of 87.00. Will close out the Naked Put Option when market open on Monday.

Will hold the Vertical Spread to test out the effect of maximum loss of Vertical Spread if ASML falls below 85.

Trade 1 : Buying Put Option - KO NOV2013 40 Put and KO DEC2013 40 Put

For the past 2 weeks, KO has been ranging around 40.00. And it seems that 40.00 will hold. As such, I will close the remaining Dec position when market opens on Monday.

Unrealized P&L ($):

As at 04-Oct : 355 (Nov: 240; Dec: 115)

As at 11-Oct : 157 (Nov: 134; Dec: 64)

As at 18-Oct : -100 (Nov: -70; Dec: -30)

As at 25-Oct : -56 (Dec: -56)

As at 08-Nov : -128 (Dec: -128)

Realized P&L ($):

KO 16NOV13 40.0 Put : $236.46 - $343.13 = $-106.67

Trade 2 : Selling Naked Put Option - ASML DEC2013 87.5 Put and ASML Vertical Spread DEC2013 87.5/85 Put

The Pin Bar didn't work out. ASML after 1 week of failing to move above 95.00, fell sharply to 87.37, near support of 87.00. Will close out the Naked Put Option when market open on Monday.

Will hold the Vertical Spread to test out the effect of maximum loss of Vertical Spread if ASML falls below 85.

Monday, October 28, 2013

Vertical Spread

In the Selling Option post, I mentioned Selling Option strategy has limited reward (the premium we received) with unlimited risk.

There is a way to address this unlimited risk by buying another Option with the same expiration and have the same underlying asset. That is a Vertical Spread.

A Vertical Spread is the simultaneous purchase and sale of options of the same class (calls or puts) and expiration, but with different strike prices.

By selling a Put at a higher price and buying another Put at lower price, it is called Bull Put Spread or Credit Put Spread. It is called Bull Put Spread strategy because it is a Bullish strategy. It is called Credit Put Spread because you will receive a positive cash flow or credit by executing this strategy.

Let's use a Example to compare and contrast Naked Put strategy with Bull Put Spread strategy.

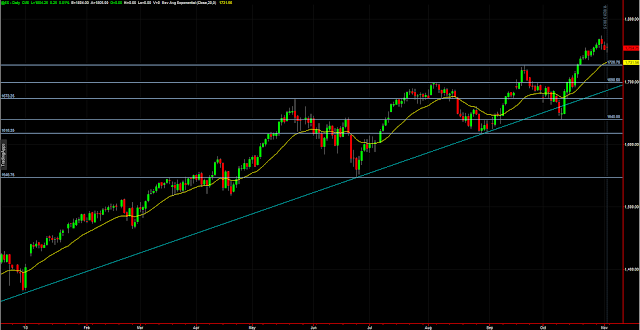

ASML has been in a bullish uptrend throughout 2013. The recent weakness has sent the price retrace to price support at 92.30. Our Stop Loss is the last swing low support at 87.00

Selling Naked Put

There is no Strike Price at 87.00. There two nearest are 85.00 and 87.50. I therefore chose 87.50 Strike price with December Expiration : ASML Dec20'13 87.5 PUT.

I queue for mid point 1.63 (Bid is 1.55; Ask is 1.70). Didn't get it after 1 hour. Decided to just buy from Bid (ya, it dropped from 1.55 to 1.50). So, I received $150 (before commission) in premium.

With the margin of $1,384, the ROM (Return on Margin) is 150/1384 = 10.83% for 63 days.

Maximum loss is unlimited or price drop to 0, ie 87.50 * 1 * 100 - 150 = $8,600.

Vertical Spread : Bull Put Spread / Credit Put Spread

Components : Sell ASML Dec20'13 87.5 PUT

Buy ASML Dec20'13 85 PUT

As the premium for the spread is very low, just $24 for 1 contract at mid point $0.48. I have to increase to 5 contracts to have a comparable size with the Naked Put position.

Same as Nake Put trade, I queued at mid point $0.48 for 1 hour without filled. Decided to just take bid price 0.35. Therefore, premium collected is $175 (before commission).

Margin, however, is only $1,250 lower than Naked Put 1 contract margin. ROM is 175/1250 = 14%.

Maximum loss = (87.5 - 85) *5 * 100 - 175 = 1,075. (difference between strikes minus credit)

Summary:

Vertical Spread address the unlimited risk we have when selling Naked Put. In addition, it requires less margin and provide a better return on margin.

There is a way to address this unlimited risk by buying another Option with the same expiration and have the same underlying asset. That is a Vertical Spread.

A Vertical Spread is the simultaneous purchase and sale of options of the same class (calls or puts) and expiration, but with different strike prices.

By selling a Put at a higher price and buying another Put at lower price, it is called Bull Put Spread or Credit Put Spread. It is called Bull Put Spread strategy because it is a Bullish strategy. It is called Credit Put Spread because you will receive a positive cash flow or credit by executing this strategy.

Let's use a Example to compare and contrast Naked Put strategy with Bull Put Spread strategy.

ASML has been in a bullish uptrend throughout 2013. The recent weakness has sent the price retrace to price support at 92.30. Our Stop Loss is the last swing low support at 87.00

Selling Naked Put

There is no Strike Price at 87.00. There two nearest are 85.00 and 87.50. I therefore chose 87.50 Strike price with December Expiration : ASML Dec20'13 87.5 PUT.

I queue for mid point 1.63 (Bid is 1.55; Ask is 1.70). Didn't get it after 1 hour. Decided to just buy from Bid (ya, it dropped from 1.55 to 1.50). So, I received $150 (before commission) in premium.

With the margin of $1,384, the ROM (Return on Margin) is 150/1384 = 10.83% for 63 days.

Maximum loss is unlimited or price drop to 0, ie 87.50 * 1 * 100 - 150 = $8,600.

Vertical Spread : Bull Put Spread / Credit Put Spread

Components : Sell ASML Dec20'13 87.5 PUT

Buy ASML Dec20'13 85 PUT

As the premium for the spread is very low, just $24 for 1 contract at mid point $0.48. I have to increase to 5 contracts to have a comparable size with the Naked Put position.

Same as Nake Put trade, I queued at mid point $0.48 for 1 hour without filled. Decided to just take bid price 0.35. Therefore, premium collected is $175 (before commission).

Margin, however, is only $1,250 lower than Naked Put 1 contract margin. ROM is 175/1250 = 14%.

Maximum loss = (87.5 - 85) *5 * 100 - 175 = 1,075. (difference between strikes minus credit)

Summary:

Vertical Spread address the unlimited risk we have when selling Naked Put. In addition, it requires less margin and provide a better return on margin.

Weekly Review

Trade 1 : Buying Put Option - KO NOV2013 40 Put and KO DEC2013 40 Put

For the past week, KO moving sideway around the 39.00. Instead of closing all position, I close all the position for Nov contract, leaving Dec contract to monitor.

Unrealized P&L ($):

As at 04-Oct : 355 (Nov: 240; Dec: 115)

As at 11-Oct : 157 (Nov: 134; Dec: 64)

As at 18-Oct : -100 (Nov: -70; Dec: -30)

As at 25-Oct : -56 (Dec: -56)

Realized P&L ($):

KO 16NOV13 40.0 Put : $236.46 - $343.13 = $-106.67

For the past week, KO moving sideway around the 39.00. Instead of closing all position, I close all the position for Nov contract, leaving Dec contract to monitor.

Unrealized P&L ($):

As at 04-Oct : 355 (Nov: 240; Dec: 115)

As at 11-Oct : 157 (Nov: 134; Dec: 64)

As at 18-Oct : -100 (Nov: -70; Dec: -30)

As at 25-Oct : -56 (Dec: -56)

Realized P&L ($):

KO 16NOV13 40.0 Put : $236.46 - $343.13 = $-106.67

Sunday, October 20, 2013

Weekly Review

Trade 1 : Buying Put Option - KO NOV2013 40 Put and KO DEC2013 40 Put

The retracement for KO was strong. It touch the second down trend line, approaching the first resistance line at 39.

The unrealized profit I had 2 weeks ago has become unrealized loss.

Unrealized P&L ($):

As at 04-Oct : 355 (Nov: 240; Dec: 115)

As at 11-Oct : 157 (Nov: 134; Dec: 64)

As at 18-Oct : -100 (Nov: -70; Dec: -30)

Do I continue to hold, hoping that it will resume the downtrend movements? Or do I cut loss now? I will wait for the next 1-2 candles to make the decision. If it raise and hold above the second down trend line and 39, I will close all position and cut loss.

Trade 2 : Selling Put Option - F Oct19'13 15 Put

F went up with the general market when debt ceiling lifted, government shutdown ended. The contract expire worthless. I got to keep the full premium of $292.29 (as stated in this post) without paying another commission to close the position.

The retracement for KO was strong. It touch the second down trend line, approaching the first resistance line at 39.

The unrealized profit I had 2 weeks ago has become unrealized loss.

Unrealized P&L ($):

As at 04-Oct : 355 (Nov: 240; Dec: 115)

As at 11-Oct : 157 (Nov: 134; Dec: 64)

As at 18-Oct : -100 (Nov: -70; Dec: -30)

Do I continue to hold, hoping that it will resume the downtrend movements? Or do I cut loss now? I will wait for the next 1-2 candles to make the decision. If it raise and hold above the second down trend line and 39, I will close all position and cut loss.

Trade 2 : Selling Put Option - F Oct19'13 15 Put

F went up with the general market when debt ceiling lifted, government shutdown ended. The contract expire worthless. I got to keep the full premium of $292.29 (as stated in this post) without paying another commission to close the position.

Subscribe to:

Comments (Atom)