Trade 1 : Buying Put Option - KO NOV2013 40 Put and KO DEC2013 40 Put

Didn't stay up to close the position on Monday. Instead close the position on Tuesday.

Unrealized P&L ($):

As at 04-Oct : 355 (Nov: 240; Dec: 115)

As at 11-Oct : 157 (Nov: 134; Dec: 64)

As at 18-Oct : -100 (Nov: -70; Dec: -30)

As at 25-Oct : -56 (Dec: -56)

As at 08-Nov : -128 (Dec: -128)

Realized P&L ($):

KO 16NOV13 40.0 Put : $236.46 - $343.13 = $-106.67

KO 21DEC13 40.0 Put : $92 - $212.07 = $-121.13

On hindsight, it was a poor trade management that turn profit into a loss.

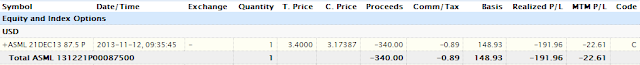

Trade 2 : Selling Naked Put Option - ASML DEC2013 87.5 Put and ASML Vertical Spread DEC2013 87.5/85 Put

Naked Put was close on the same Tuesday, taking a loss of $-191.96.

I continue to keep the Vertical Spead. It has a little profit now as the price bounced off from the support at 86.96.

No comments:

Post a Comment