I didn't do the last week review because I was on 4 days vacation from last Sunday. Let's continue this week.

N225 closed at 15,349.42 on Friday, 20-Jun-2014, gained 251.58 (1.67%) over the last 5 days. NKVI moved down 2.22 (11.29%) ending the week at 17.44.

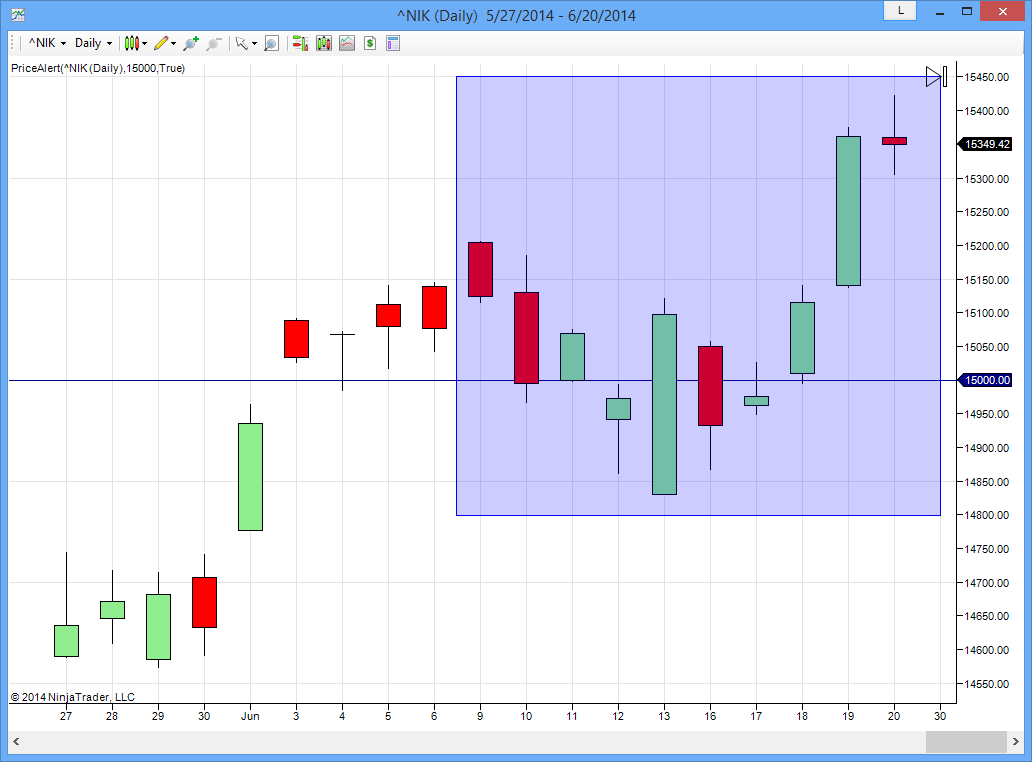

In the last two weeks, N225 dipped below 15,000 for a few times on the Daily chart.

However, on the Weekly chart, N225 has defended well. It rejected 15,000 strong in both weeks.

In my last review, I mentioned that N225 should be able to break its previous high at 15312,60. It didn't make it last week but it made it this week. The next number we should be looking at will be around 15,800.

I stop writing about NKVI in the last review. But I am bringing it back because of the alarming low volatility.

NKVI has never been so low for a long long time. The only period that has NKVI lower than 17.44 is Oct-Dec 2012 and Jan-Feb 2011 (source : http://indexes.nikkei.co.jp/en/nkave/index/profile?cid=6&idx=nk225vi).

I cannot find a market data source that I can plot both N225 and NKVI together, yet. I will use Interactive Broker for the time being. I don't trust IB's data (as mentioned in this post). And IB NKVI data is only back up to Mar 2012.

Anyhow, as you can see from the below IB chart, the Oct-Dec 2012 period is the period before N225 has its historical climb from around 8,500 to around 16,000 from Nov 2012 to May 2013!

If you refer to the Daily Chart below, the climb is with very few pull back. Such environment is very difficult to trade selling option, especially Iron Condor. It will creep slowly towards your short strike of the call side. With volatility so low, the typical methods of rolling up and / or out are unattractive or not possible. In fact, the rolling up or out will again get hit pretty soon.

I will do a more detail analysis using more reliable data source and chart in the coming weeks. This is getting me uneasy.

SPX closed at 1963.91, record high again, up 3.39 points on Friday. This would likely push N225 higher on Monday.

No comments:

Post a Comment