The next simple strategy we shall consider is : Buying Put Options. Similar to Buying Call Options, it is simple because we can relate it to Shorting Stocks or Futures or Forex. It is also attractive to beginners because maximum profit potential is unlimited while maximum loss potential is limited to premium paid.

Even though Buying Put Options is similar to Shorting Stocks or Futures or Forex when you have a bearish view on the Stocks or Futures or Forex, there is a one very big difference. For Stocks or Futures or Forex, you are Shorting, means you are Selling. For Put Options, you are actually Buying.

So, when you have established a bearish view on XYZ stock. You will Short/Sell the XYZ stock. If you use Put Options, you will instead Long/Buy the Put Options.

Call Options give the Buyer the right to Buy the underlying Stock at Strike Price.

Put Options give the Buyer the right to Sell the underlying Stock at Strike Price.

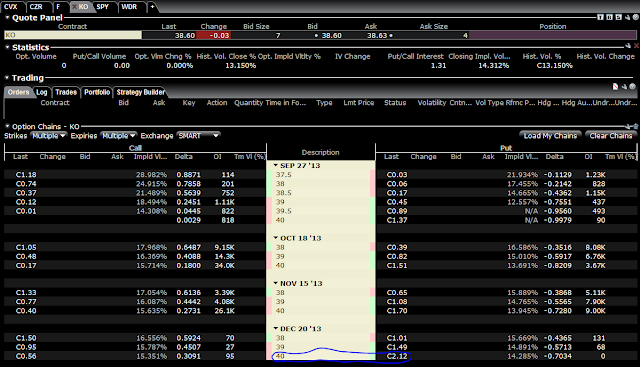

Let me use an example to illustrate. KO is trading at 38.63 after it failed to break the resistance at 39.60. And it fell below the downtrend line. We are bearish on KO. We can Short/Sell KO at current price 38.63 with a stop above the resistance line 39.60, say at 40.00.

To implement that in KO Put Options, I will use the same guideline established in Buying Call Options (see the post here):

1. Underlying Stock : KO

2. Expiration : at least 2 months

3. Strike Price : ITM and Stop Loss price

4. Call or Put : Put

5. Price :

So, I will buy KO Dec20'13 40 Put @ 2.12 (yesterday close). Using Options Calculator, the theoretical Options price is about 1.94 when KO is at 38.63 and about 1.13 when KO is at 40. The potential lost is about $81 (1.94-1.13 * 100). The theoretical price is different from (lower than) the actual market price. I hope the difference is about the same.

No comments:

Post a Comment