K200 closed at 259.94 on Friday, 30-May-2014, lost 3.48 (1.32%) over the last 5 days, swing up and down in about 4.5 points range.

K200 is still undecided to reverse from Fibonacci 76.40% or to test 100%. I would like to see it break down the previous previous high at 258.76 to get a clearer retracement down move. Let's not forget it is still having higher high higher low. Still uptrend. Let's see.

This blog is to pen down my journey of trading Options. I focus primary on the Options in Asia Pacific, especially KOSPI 200 Options in Korea Stock Exchange (KRE). The main strategy is Selling Options, in particular Credit Spread and Iron Condor.

Saturday, May 31, 2014

Weekly Market Reivew N225

N225 closed at 14,632.38 on Friday, 30-May-2014, gained 170.21 (1.18%) over the last 5 days. NKVI moved down 1.22 (5.82%) ending the week at 19.75.

After N225 move up to close above 14,600 on Monday. The following days in the week were in a very tight range of 150 points (14,600 - 14,750).

N225 has broken out of the 600 points range I mentioned in previous weeks review. It has stayed above it for the 5 trading days.

We didn't get the lower low to establish a short term down trend. What we get is a higher high which give us no trend. Will it continue its climb to test previous high at 15164.39? With 40 days to expiration for July contract and 75 days to expiration for August contract, is 15,500 Strike too near?

NKVI at 19.75 is still at the lowest for the past 17 months, except on 8 & 9 Jan 2013 (19.06 & 19.42 respectively). At this low volatility, I find it hard sell contract with good premium. However, the range bouncing that N225 has been moving for past weeks/months also help to close the contracts, despite lower premium, with profit. I rarely hold contract to expiration nowadays. Will have a separate post to explain that and update my trading plan.

SPX closed at 1923.57, record high, up 3.54 points on Friday. This would likely to keep N225 above 14,600, if not provide some push on Monday.

After N225 move up to close above 14,600 on Monday. The following days in the week were in a very tight range of 150 points (14,600 - 14,750).

N225 has broken out of the 600 points range I mentioned in previous weeks review. It has stayed above it for the 5 trading days.

We didn't get the lower low to establish a short term down trend. What we get is a higher high which give us no trend. Will it continue its climb to test previous high at 15164.39? With 40 days to expiration for July contract and 75 days to expiration for August contract, is 15,500 Strike too near?

NKVI at 19.75 is still at the lowest for the past 17 months, except on 8 & 9 Jan 2013 (19.06 & 19.42 respectively). At this low volatility, I find it hard sell contract with good premium. However, the range bouncing that N225 has been moving for past weeks/months also help to close the contracts, despite lower premium, with profit. I rarely hold contract to expiration nowadays. Will have a separate post to explain that and update my trading plan.

SPX closed at 1923.57, record high, up 3.54 points on Friday. This would likely to keep N225 above 14,600, if not provide some push on Monday.

Sunday, May 25, 2014

Weekly Market Reivew K200

K200 closed at 263.42 on Friday, 23-May-2014, gained 0.45 (0.17%) over the last 5 days, up and down in directionless way.

K200 seems to be in a pause mode, undecided to go up or down. Base on Fibonacci Extensions, it is at its 76.40% mark, which is also a good place if it decided to reverse and go down. Or it could target towards 100% zone like the previous run up.

K200 seems to be in a pause mode, undecided to go up or down. Base on Fibonacci Extensions, it is at its 76.40% mark, which is also a good place if it decided to reverse and go down. Or it could target towards 100% zone like the previous run up.

Saturday, May 24, 2014

Weekly Market Reivew N225

N225 closed at 14,462.17 on Friday, 23-May-2014, gained 365.58 (2.59%) over the last 5 days. NKVI moved down 0.05 (0.24%) ending the week at 20.97.

N225 dropped below 14,000 twice, on Monday and Wednesday. But it closed above 14,000 on both days. Thereafter, it jump back to 14,500 areas. Looks like 14,000 is holding well.

N225 is still within the 600 points range I mentioned in last week review. In fact, it is in the mid of the previous range (in green) we discussed a few weeks ago. Until, we see a clear break above previous high or below previous low, it is in a state of directionless.

NKVI at 20.97 is still at the lowest for the past 12 months. This low volatility is not so good for option seller when you are looking for opportunities to sell.

SPX closed at 1900.53 up 8.04 points on Friday. This would likely provide some push to N225 on Monday.

N225 dropped below 14,000 twice, on Monday and Wednesday. But it closed above 14,000 on both days. Thereafter, it jump back to 14,500 areas. Looks like 14,000 is holding well.

N225 is still within the 600 points range I mentioned in last week review. In fact, it is in the mid of the previous range (in green) we discussed a few weeks ago. Until, we see a clear break above previous high or below previous low, it is in a state of directionless.

NKVI at 20.97 is still at the lowest for the past 12 months. This low volatility is not so good for option seller when you are looking for opportunities to sell.

SPX closed at 1900.53 up 8.04 points on Friday. This would likely provide some push to N225 on Monday.

Saturday, May 17, 2014

Weekly Market Reivew K200

K200 closed at 262.97 on Friday, 16-May-2014, gained 8.66 (3.41%) over the last 5 days, in almost a straight line up, ignore all the down from SPX.

K200 established a higher high (263.17) on Thursday, despite by just a very small number over last high (262.87).

From the last Fibonacci Extensions, it climb slightly above 100%. Will it repeat again this round? Testing 267.5 or 270.0, the next two Strike price above 100%? Let's see.

K200 established a higher high (263.17) on Thursday, despite by just a very small number over last high (262.87).

From the last Fibonacci Extensions, it climb slightly above 100%. Will it repeat again this round? Testing 267.5 or 270.0, the next two Strike price above 100%? Let's see.

Weekly Market Reivew N225

N225 closed at 14,096.59 on Friday, 16-May-2014, lost 103 (0.73%) over the last 5 days. NKVI moved down 0.45 (2.10%) ending the week at 21.02.

While I mentioned last week that N225 broke down out of the tight range (+/- 100 pts), it seems to be still in a range, a wider 600 points range, with 14,000 holding the support. N225 rallied up to just mid point of last +/- 100 pts range before it plunged down on Friday, but keeping afloat on 14,000.

600 points range is not really a wide range for N225 when it could move easily 300-400 in a single day.

It is good for option seller that N225 stay in a range (when you already sold your options, not when you are looking to sell option). But I am not going to bet it stay in the range for long.

Will N225 break 14,000 and thereafter the last low, then established a short term down trend? Or will it break the last lower high, giving directionless and stay in a wider 1000 points range? Let the market tells us.

NKVI at 21.02 is still at the lowest range of 20-30 for the past 6 months. In fact, NKVI was at 19.87 on Thursday. A number that we have not seen since January 2013 when N225 was at 10,000+.

Is this low volatility implying investors/traders are confidence that 14,000 will hold?

SPX broke 1900 on Tuesday without much fanfare. And it didn't close above it. While I feel that SPX is loosing strength to climb, it is no doubt still on up trend (higher high, higher low). So, until we see otherwise, it is still uptrend, despite moving slower.

SPX closed at 1877.86 up 7.01 points on Friday.

While I mentioned last week that N225 broke down out of the tight range (+/- 100 pts), it seems to be still in a range, a wider 600 points range, with 14,000 holding the support. N225 rallied up to just mid point of last +/- 100 pts range before it plunged down on Friday, but keeping afloat on 14,000.

600 points range is not really a wide range for N225 when it could move easily 300-400 in a single day.

It is good for option seller that N225 stay in a range (when you already sold your options, not when you are looking to sell option). But I am not going to bet it stay in the range for long.

Will N225 break 14,000 and thereafter the last low, then established a short term down trend? Or will it break the last lower high, giving directionless and stay in a wider 1000 points range? Let the market tells us.

NKVI at 21.02 is still at the lowest range of 20-30 for the past 6 months. In fact, NKVI was at 19.87 on Thursday. A number that we have not seen since January 2013 when N225 was at 10,000+.

Is this low volatility implying investors/traders are confidence that 14,000 will hold?

SPX broke 1900 on Tuesday without much fanfare. And it didn't close above it. While I feel that SPX is loosing strength to climb, it is no doubt still on up trend (higher high, higher low). So, until we see otherwise, it is still uptrend, despite moving slower.

SPX closed at 1877.86 up 7.01 points on Friday.

Monday, May 12, 2014

Option Greeks: DELTA

Delta is a measure of the change in the option's price resulting from a change in the underlying stock price.

Delta is an estimate of how much the theoretical value of an option will change when the price of the underlying stock changes by $1, assuming all other variables are unchanged.

Delta is the only Option Greek that has a different value for Calls and Puts:

Positive Delta means that the option's value will increase when the underlying stock price rise, and will decrease when the stock price drop

Negative Delta means that the option's value will increase when the underlying stock price drop, and will decrease when the stock price rise

Delta and the position in the market:

When you Long a Calls say at $1.00, with Delta say at 0.10, your option will be $1.10 when the underlying stock rise by $1 (assuming all other variables are unchanged).

When you Short a Calls say at $1.00, with Delta say at 0.10, your option will be $0.90 when the underlying stock rise by $1 (assuming all other variables are unchanged).

It is not so straight forward when you have a Spread, where you have a Short options and a Long options. Take for example, the N225 Jul10 15500/15750 Call Bear Spread in the diagram below.

Call Bear Spread

N225 Jul10 15500 Call 0.1691

N225 Jul10 15750 Call 0.1215

While both of the Call options (15500 and 15750) are having positive Delta, The Call Bear Spread is having a negative Delta. This is because in Call Bear Spread, you Short 15500 Call and Long 15750 Call. The Short 15500 Call will have negative Delta and the Long 15750 Call will have positive Delta.

-0.1691 + 0.1215 = -0.0476

Thus, the Call Bear Spread is in fact having a negative Delta of 0.0476, as indicated in the Quote Panel above. The Call Bear Spread position will gain 0.0476 value if the underlying stock price (N225) drop by 1 point (assuming all other variables are unchanged).

Delta is an estimate of how much the theoretical value of an option will change when the price of the underlying stock changes by $1, assuming all other variables are unchanged.

Delta is the only Option Greek that has a different value for Calls and Puts:

- Positive number for Calls (0 to 1)

- Negative number for Puts (-1 to 0)

Positive Delta means that the option's value will increase when the underlying stock price rise, and will decrease when the stock price drop

Negative Delta means that the option's value will increase when the underlying stock price drop, and will decrease when the stock price rise

Delta and the position in the market:

- Long Calls have positive Delta; Short Calls have negative Delta

- Long Puts have negative Delta; Short Puts have positive Delta

When you Long a Calls say at $1.00, with Delta say at 0.10, your option will be $1.10 when the underlying stock rise by $1 (assuming all other variables are unchanged).

When you Short a Calls say at $1.00, with Delta say at 0.10, your option will be $0.90 when the underlying stock rise by $1 (assuming all other variables are unchanged).

Call Bear Spread

N225 Jul10 15500 Call 0.1691

N225 Jul10 15750 Call 0.1215

While both of the Call options (15500 and 15750) are having positive Delta, The Call Bear Spread is having a negative Delta. This is because in Call Bear Spread, you Short 15500 Call and Long 15750 Call. The Short 15500 Call will have negative Delta and the Long 15750 Call will have positive Delta.

-0.1691 + 0.1215 = -0.0476

Thus, the Call Bear Spread is in fact having a negative Delta of 0.0476, as indicated in the Quote Panel above. The Call Bear Spread position will gain 0.0476 value if the underlying stock price (N225) drop by 1 point (assuming all other variables are unchanged).

Saturday, May 10, 2014

Weekly Market Reivew K200

K200 closed at 254.31 on Friday, 9-May-2014, lost 0.76 (0.31%) over the last 3 trading days, recovering most of the lost on Wednesday.

In my last week review, I mention that K200 could move down to the support at 252. It did and rejected it and moved up.

Looking at the Fibonacci Retracement, the last retracement stop at 76.40% before it climb up. This latest retracement happened at exactly the same 76.40%. I am not a fan of Fibonacci. I don't trade using it. However, I always use it as a guide, especially when it coincide with my support and resistance.

We have a series of higher high and higher low in K200 Daily chart now. Will K200 resume its short term uptrend and continuing its climb? Let's see.

In my last week review, I mention that K200 could move down to the support at 252. It did and rejected it and moved up.

Looking at the Fibonacci Retracement, the last retracement stop at 76.40% before it climb up. This latest retracement happened at exactly the same 76.40%. I am not a fan of Fibonacci. I don't trade using it. However, I always use it as a guide, especially when it coincide with my support and resistance.

We have a series of higher high and higher low in K200 Daily chart now. Will K200 resume its short term uptrend and continuing its climb? Let's see.

Weekly Market Reivew N225

N225 closed at 14,199.59 on Friday, 9-May-2014, lost 257.92 (1.78%) over the last 3 trading days. NKVI moved slightly up ending the week at 21.47.

N225 broke down out of the tight range (+/- 100 pts) after the two days public holiday. And this established the lower high we mentioned in the past 2 weeks.

In last two weeks review, I mentioned if we have a lower high, we may end with a lower low breaking the past low of 13750 or/and 13180. 14,000 remains to be the psychological support. The break of last low 13,885.11 will mean we have a lower low, establishing a short term down trend.

NKVI at 22.47 is still at the lowest range of 20-30 for the past 3 months. There are only 5 days in 2014 that were lower than 22.47, with two days happened on last two days in last week. Will we get back to 25+/- soon?

SPX closed at 1878.48, just 2.85 points up on Friday. Why do I feel that SPX is loosing strength to climb up?

N225 broke down out of the tight range (+/- 100 pts) after the two days public holiday. And this established the lower high we mentioned in the past 2 weeks.

In last two weeks review, I mentioned if we have a lower high, we may end with a lower low breaking the past low of 13750 or/and 13180. 14,000 remains to be the psychological support. The break of last low 13,885.11 will mean we have a lower low, establishing a short term down trend.

NKVI at 22.47 is still at the lowest range of 20-30 for the past 3 months. There are only 5 days in 2014 that were lower than 22.47, with two days happened on last two days in last week. Will we get back to 25+/- soon?

SPX closed at 1878.48, just 2.85 points up on Friday. Why do I feel that SPX is loosing strength to climb up?

Friday, May 9, 2014

K200 Chart is back, for just a few hours

I was happy to see the full K200 Chart this morning 9am, with no missing data. I reported about KOSPI 200 data feed problem in this post. It was there till 11.27am Singapore Time.

However, it was gone at 11.32 am Singapore Time.

I don't know what is Interactive Brokers (IB) doing (applying fixes?), during trading hours. While I am not happy with that, I am looking forward to having a working K200 Chart soon, I hope.

However, it was gone at 11.32 am Singapore Time.

I don't know what is Interactive Brokers (IB) doing (applying fixes?), during trading hours. While I am not happy with that, I am looking forward to having a working K200 Chart soon, I hope.

Thursday, May 8, 2014

K200 Option Greeks gone!

Korea Stock Exchange resumed trading on Wednesday, 7-May-2014, after having holidays on Monday and Tuesday. Ever since, I have been trading "blindfolded". The K200 Option Greeks are not available in IB! They are all ZERO!

Am I the only one trading K200 Index Option in IB? How can one trade Option without the Option Greeks : Delta, Gamma, Vega and Theta?

I reported the problem on Wednesday. Today is Friday. The problem is still not fixed.

Am I the only one trading K200 Index Option in IB? How can one trade Option without the Option Greeks : Delta, Gamma, Vega and Theta?

I reported the problem on Wednesday. Today is Friday. The problem is still not fixed.

Sunday, May 4, 2014

Weekly Market Reivew K200

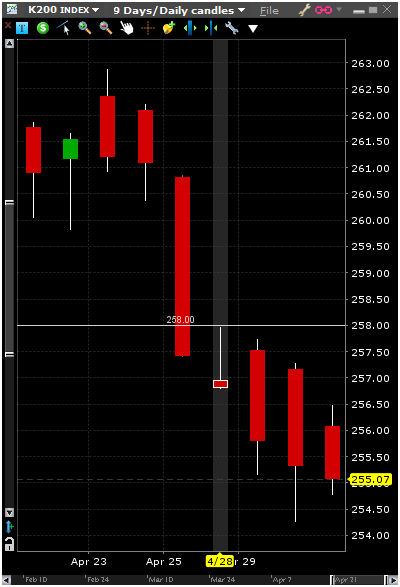

K200 closed at 255.07 on Friday, 2-May-2014, lost 2.35 (0.91%) over the last 4 days (Temporary closing of KRX on 1-May, Labor Day), in a straight line down.

In my last week review, I mention that the support zone of 257-258. K200 open about 257 on Monday , tried to push through 258. Failed and close below 257. It continued moving down despite SPX moved up for the few days.

K200 still looks bearish to me. Until it shows some bullish signal, I believe it could move down to next support about 252 area.

KRX close on Monday and Tuesday (5-6 May 2014). Let's see how K200 perform for the short trading week.

In my last week review, I mention that the support zone of 257-258. K200 open about 257 on Monday , tried to push through 258. Failed and close below 257. It continued moving down despite SPX moved up for the few days.

K200 still looks bearish to me. Until it shows some bullish signal, I believe it could move down to next support about 252 area.

KRX close on Monday and Tuesday (5-6 May 2014). Let's see how K200 perform for the short trading week.

Saturday, May 3, 2014

Weekly Market Reivew N225

N225 closed at 14,457.51 on Friday, 2-May-2014, gained 28.25 (0.20%) over the last 5 days. NKVI moved down to 20.49 on Friday, the lowest for the past 6 months.

In last two weeks review, I mentioned if we have a lower high, we may end with a lower low breaking the past low of 13750 or/and 13180. Howerver, N225 has been moving in a tight range (+/- 100 pts) ever since it move to 14417 on 16-Apr-2014 from the last low of 13910 on 14-Apr-2014.

Stock markets move up and down daily. It is rarely that they stay in a tight range for too long. I believe it will move out of this tight range soon.

NKVI at 20.49 is the lowest for the past 12 months, except on 18-Oct-2013 with a low of 19.99. Such a low volatility is unusual. Thus, this support the view that the breakout of the tight range will happen soon. I think the breakout would likely to be on the down side. Monday and Tuesday (5-6 May 2014) are Japan public holidays. Let's see what the market is after that.

SPX close at 1881.14, a drop of 2.54 (0.13%) on Friday, failed to break the high at 1897.28. Does that imply weakness or at least lack of strength?

In last two weeks review, I mentioned if we have a lower high, we may end with a lower low breaking the past low of 13750 or/and 13180. Howerver, N225 has been moving in a tight range (+/- 100 pts) ever since it move to 14417 on 16-Apr-2014 from the last low of 13910 on 14-Apr-2014.

Stock markets move up and down daily. It is rarely that they stay in a tight range for too long. I believe it will move out of this tight range soon.

NKVI at 20.49 is the lowest for the past 12 months, except on 18-Oct-2013 with a low of 19.99. Such a low volatility is unusual. Thus, this support the view that the breakout of the tight range will happen soon. I think the breakout would likely to be on the down side. Monday and Tuesday (5-6 May 2014) are Japan public holidays. Let's see what the market is after that.

SPX close at 1881.14, a drop of 2.54 (0.13%) on Friday, failed to break the high at 1897.28. Does that imply weakness or at least lack of strength?

Subscribe to:

Comments (Atom)